Singapore is globally renowned for its ease of doing business. For foreigners, setting up a business in the city-state is highly desirable.

Setting Up A Business in Singapore

Singapore’s pro-business environment did not happen overnight. Built on a long history of international trade and finance, a track record of open immigration and hardworking, talented individuals, Singapore’s business landscape is recognised for its competitiveness, well-regulated nature and stability. Singapore is regarded as the “gateway to Asia” for its strong connections to the Southeast Asian region and beyond.

- Singapore is ranked 1st in Asia and in the top 4 financial centres worldwide by the Global Financial Centres Index (GFCI).

- Singapore’s pro-business environment is enabled by its diverse suite of financial services, transparency and competitiveness, business-friendly policies and exemplary political stability.

- This environment is built on a rich legacy of immigrant enterprise, trade and exchange given Singapore’s historical role as a maritime trading port and regional business centre. Singapore was built on the backs of immigrants.

- Business owners working in Singapore’s fast-growing industries will stand to gain from Singapore’s regional and international connectivity, global reputation and tax incentives.

A Brief History of Singapore’s Immigration

Singapore’s history of business extends well beyond its colonial history, and is inextricably intertwined with immigration. Records from as early as the 14th century prove Singapore’s key role as a centre of international trade during the Srivijayan period. During the colonial period, immigrants from Southern China and South India sailed to Singapore in search of a better life. Many of these immigrants became entrepreneurs, starting up businesses of their own once released from indentured labour.

Over the course of a century, their businesses evolved in complexity and function. Today, many of these old businesses have become large institutions: the United Overseas Bank (UOB) and Shaw Brothers and many more. More importantly, these immigrants leave behind a rich legacy of enterprise. Local success stories include that of the Ng brothers of the Far East Organisation; foreign business owners who have become Singaporean residents include Eduardo Saverin, co-founder of Facebook.

Incorporating in Singapore: A Global Financial Hub

In 2023, Singapore overtook Hong Kong to become the top financial hub in the Asia-Pacific and one of the top four financial centres in the world. The Global Financial Centres Index (GFCI) also revealed that Singapore is likely to become “more significant in the region”, right behind Seoul.

There are several reasons for Singapore’s feat. Firstly, Singapore is rich in talent in the key areas of banking, investment management and professional services. Over the years, Singapore has developed a rich ecosystem of bankers, legal counsels, management consultants and firms, creating a self-sustaining financial ecosystem. With a full range of services readily available in one place, business owners and financiers find Singapore an attractive destination for incorporation. On the GFCI, Singapore ranks 3rd in insurance, 4th in professional services and 5th in investment management and banking.

Secondly, Singapore’s business landscape is supported by a robust and transparent regulatory regime. Institutions like MAS (Monetary Authority of Singapore) and ACRA (Accounting and Corporate Regulatory Authority) have laid down clear rules surrounding issues such as auditing and company incorporation. These rules are well-enforced through regular checks and rigorous registration processes. Singapore also hosts many local and multinational compliance risk agencies that help foreign companies decode and abide by the rules and regulations.

Thirdly, incorporating a business in Singapore is easy for foreigners. To encourage business activity, Singapore has streamlined the incorporation process by introducing clear incorporation roadmaps by business type, tax incentives & exemptions and policies. The headline corporate tax rate is 17%, which is lower than most countries. Newly-incorporated companies are exempted from paying certain taxes in their first three years of operation. All these policies lower the barriers to entry for foreigners wishing to incorporate in Singapore and make it an attractive destination for doing business.

Finally, the country’s social and political stability is exemplary. Singaporean society is defined by diversity and harmony, cultural celebrations are observed year round and instances of instability such as riots are extremely rare. Singapore’s stability creates the predictability needed for businesses to flourish and plan for the future, which is especially valuable given the unstable situation in other hubs such as Hong Kong. Foreign business owners will thus find in Singapore an extremely conducive environment for incorporation, growth and long term development.

Indeed, the success of Singapore as a financial and business hub can be seen from the slew of MNCs establishing headquarters in the country in recent years. In 2022, Dyson relocated its global headquarters to Singapore, settling down in the historic St James Power Station. Its founder, Sir James Dyson, has established a family office in the country. Google has also set up its APAC headquarters in Singapore, where it hosts its APAC data centre and plots its APAC-wide strategies.

For aspiring business owners interested in following in these MNCs’ footsteps, incorporation in Singapore opens up the ability to tap on Singapore’s numerous trade and business agreements with other states and the state’s global reputation for integrity and transparency, opening up opportunities to enter or expand into markets that they may otherwise have limited access to.

Fast-Growing Industries in Singapore

Singapore’s three fastest-growing industries are its technology, finance and aerospace sectors.

Technology

Singapore is experiencing rapid growth in Industry 4.0 technologies: artificial intelligence, machine learning and the Internet of Things. In line with the rise of these new technologies, demand for data analytics professionals, artificial intelligence scientists and tech entrepreneurs is increasing dramatically.

A key example of the rise of tech is the emergence of Web3 technology such as the metaverse. As more companies relocate to Singapore, many seek to integrate Web3 technologies into their business model. This represents massive potential for Web3 in Singapore: tech innovators and business owners can develop new technologies and experiences for Web3 platforms and deepen existing Web3 functionalities. Entrepreneurs can introduce the technology to emerging markets with large digital presences like Indonesia and the Philippines. Given its status as the “gateway to Asia” and its reputation for world-class talent, Singapore is seeing increased activity in these areas of Web3 development.

Finance

The finance sector is picking up again as more expatriates move back to Singapore. A huge part of this influx comes from China, many of whom are ultra high net worth individuals (UHNWIs).

One result of this development is the proliferation of family offices. Family offices are established to manage the finances of UHNWIs, who have the resources and capital necessary to support investment and business activity. With more UHNWIs in Singapore, more funds can go into investment vehicles that support local businesses large and small, giving rise to even more innovation and economic growth. As travel restrictions in China loosen and Singapore’s economy recovers, we can expect momentum to grow in this area.

Aerospace

During the pandemic, the aerospace industry recorded significant growth despite the numerous lay-offs resulting from travel restrictions. As the pandemic recedes into the background, leisure and business travel are picking up again. The rise of Industry 4.0 also represents new areas of development as artificial intelligence and machine learning are incorporated into aerospace technology.

Due to the new influx of expatriates and firms, aerospace research and private air travel are becoming more prominent. Aerospace firms such as Pratt and Whitney have established research centres and tech accelerators to meet future demand. Aircraft MRO (maintenance, repair and overhaul) activities have also increased, creating new opportunities for technological innovation.

Can Foreigners or Non-Residents Set Up Businesses in Singapore?

Foreigners and non-residents are absolutely welcome to set up a company in Singapore.

For foreign business owners interested in incorporating in Singapore, they need not be physically present in the country to register or even run the company. Foreign or non-resident company owners are also allowed to hold 100% of the shares in their company. However, across all company types, all of the following must hold:

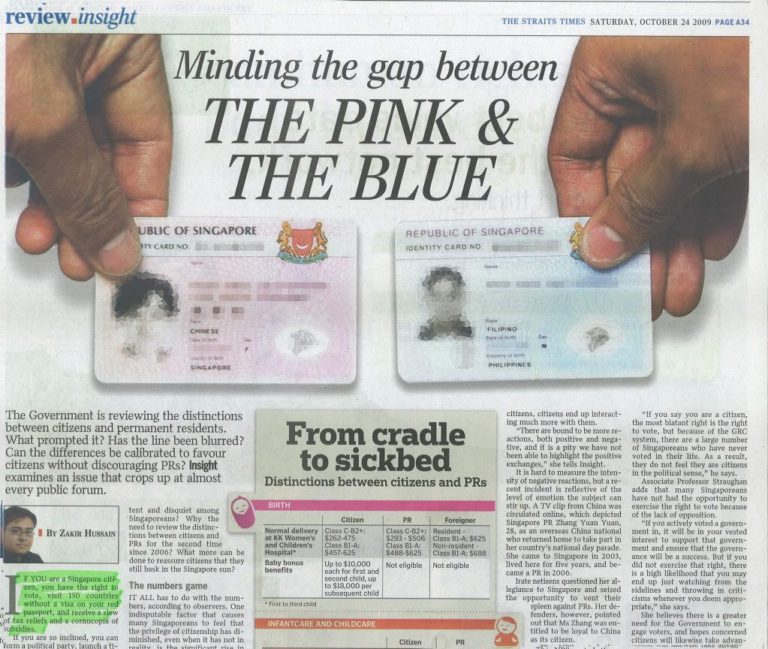

- At least one key personnel in the company is an “ordinary resident”— a Singaporean citizen, Permanent Resident or Employment/EntrePass holder

- The company must be approved by ACRA before it can proceed with operations

- The company must have a local mailing address in the country

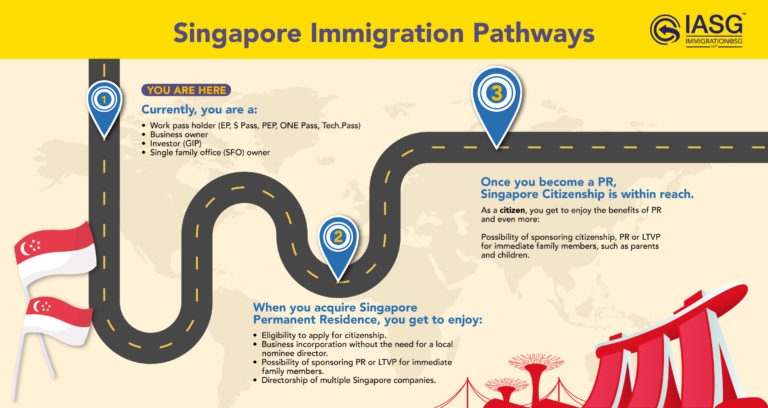

Non-resident owners relocating to Singapore long-term to run their companies must apply for an Employment Pass (EP) or EntrePass. Foreign owners making a brief visit to settle company matters may opt for a short-term visit pass (STVP) or long-term visit pass (LTVP) depending on their personal needs.

Can Foreigners Be Shareholders in the Company?

Foreigners are allowed to hold 100% of the shares in their companies. The company itself must have a minimum of one shareholder—this shareholder can be a local or foreigner.

Can Foreigners be the Director of the Company?

Yes, foreigners can be the directors of their companies. It is possible for foreigners to be the sole or actual director of the company.

Depending on company type, however, foreigners must appoint at least one “ordinary resident” to be the local manager, nominee director or company secretary. This is to ensure that the business has some concrete physical presence in Singapore, and need not reflect the reality of the company’s operations on the ground. For example, a Singaporean nominee director of a company may not have any actual say in the day-to-day running of the company.

Many companies in Singapore are run by both foreign and local directors, where the local director is personally involved in the company’s operations. However, as long as the company formally indicates local representation on the ACRA registration forms and has at least one local key personnel, foreign business owners are allowed to be company directors.

Can a Foreigner Open a Bank Account in Singapore?

Depending on company type, foreigners are allowed to open bank accounts in Singapore.

Foreign business owners of a private limited company are allowed to open a corporate bank account once the company has been incorporated (i.e. obtained ACRA approval and prepared company resolution and relevant documents to open the account). While most banks require account signatories and directors to be physically present in Singapore to open the bank account itself, some banks allow non-resident owners not in the country to sign documents at a Notary Public or another branch abroad.

Foreign business owners who are sole proprietors or limited partners are also allowed to open corporate bank accounts once their businesses have been incorporated. Similarly, account signatories and directors should be physically present in Singapore to open the bank account unless alternative arrangements can be made with the bank.

Can a Foreign Company Do Business in Singapore?

Foreign companies are welcome to conduct business in Singapore, as long as they are registered with ACRA and have their approval to do so. They must seek permission from ACRA before engaging in business activities.

Foreign companies wishing to engage in every possible business activity in Singapore are advised to register a subsidiary in the country. The subsidiary functions similarly to a locally-incorporated company and enjoys most of the same benefits and privileges.

However, certain foreign company types are not allowed to engage in revenue generating activities in Singapore:

- Representative offices are prohibited from revenue-generating activities. They may only conduct market research or coordinating activities.

- Branch offices are limited to activities that can be performed in Singapore by their foreign parent companies, and are not allowed to engage in all business activities unless express permission is granted by ACRA.

What Business Entities Are There in Singapore?

In Singapore, foreign business owners can register the following types of companies:

| Locally Incorporated(Domiciled in Singapore) | Incorporated Abroad(Domiciled in Another Country) |

| Sole proprietorships, Limited liability partnerships (LLPs), Private limited companies (Pte Ltd. or Ltd.) | Subsidiary, Branch Office, Representative Office Single Family Office |

Locally-incorporated companies refer to companies registered as Singapore-based companies. For companies that are incorporated abroad, a subsidiary functions similarly to a Singapore-based company; it is effectively the Singaporean arm of the company, and therefore treated as a Singapore-based company.

Branch and representative offices are not given the same treatment as they simply represent the company in Singapore formally, but are not Singaporean companies by nature, and therefore do not engage in formal business activities like a proper Singapore-based company would.

What are the Differences Between Setting Up a Family Office and a Company in Singapore?

A family office is a private wealth management firm for affluent individuals (ultra high net worth individuals, or UHNWIs) to manage their immense wealth. Family offices are one-stop destinations that offer these individuals every financial and investment advisory service possible: budgeting, investment planning, succession planning and charity giving among others. Family offices also handle private matters such as childcare, travel and household expenses, and are essentially tailored to serve every unique need of the family in question. They serve objectives that are personal to the family in question. Single family offices are set up for a single individual and their family to manage their wealth; they only serve one family.

While single family offices and private limited companies share similar incorporation processes, the pathway to incorporation for family offices is less straightforward. Incorporation is highly dependent on:

- Main investment strategies and financial objectives of the family office

- Assets (equities, businesses and investments) held by the family office

- Governing structure of the family office

- Needs that have not been met that the family office hopes to meet in Singapore

Single family office incorporation is co-handled by EDB (Economic Development Board) and requires other stakeholders.

How to Set Up a Company in Singapore as a Foreigner?

Foreigners must engage a registered filing agent, such as a law firm or accounting firm, to submit the application on their behalf. Foreigners are not allowed to submit a registration on their own.

Before getting started on the incorporation process, foreign owners must consider the following points:

- Deciding on the right business structure. In the previous sections, we have covered the various business types that can be incorporated in Singapore.

- Deciding on a name. Names should be meaningful, unique and memorable, non-vulgar, not infringe existing trademarks and approved should it contain regulated words such as “bank” or “finance”. Inclusion of “Singapore” should be bracketed.

Once these decisions have been made, businesses need to begin preparations.

Required Documents When Registering a Business in Singapore

While the documents required for each company type may differ, the following documents are needed for private limited companies in particular:

- Letters of Consent for EP, Dependant or EntrePass holders

- Company name

- Commencement date

- Description of business activities

- Share capital

- Shareholder information

- Director information

- Constitution

- Registered address

- Company secretary information

IASG can advise you on the preparations needed to kickstart the registration process.

Process of Setting Up a Business in Singapore For Foreigners

For every business type in Singapore, the pathway to incorporation is roughly similar:

| Step 1 | Information gathering and advisory | Companies must decide on their key business activities, division of shares, share capital, name and so onCompanies should also familiarise themselves with the laws of the landAt this stage, companies should ideally engage an agent to advise them on the preparations needed |

| Step 2 | Preparation | Companies should prepare all relevant documentsFor foreign owners relocating to Singapore, relevant applications for work passes such as the EP, EntrePass or ONE Pass must be madeFor existing EP/EntrePass/Dependant’s Pass holders, a Letter of Consent must be obtained from the Ministry of ManpowerAt this stage, companies should ideally engage an agent to advise them on the documents needed, as these documents look different from company to company |

| Step 3 | Registration | Companies approach an agent to assist them with the filing of documentsAgent submits the application on BizFile |

| Step 4 | Incorporation | Once approved, companies can start formally establishing the business by setting up corporate bank accounts and drawing up long-term plansCompanies can approach agents to assist them with follow-up action |

IASG has established procedures to ease the company registration process at every stage:

- Conducting an initial profiling of the business and providing advisory on local laws and regulations pertaining to business registration.

- Preparing all necessary documents and handling work pass applications for foreign business owners or directors seeking relocation.

- Registering the company with ACRA.

- Opening a corporate bank account, assisting with the search for key personnel and advising on other follow-up actions.

How Much Does It Cost To Start a Business in Singapore as a Foreigner?

Incorporation fees vary depending on business type. Application fees charged by ACRA are tabled below:

| Sole Proprietorship | Limited Liability Partnership | Private Limited Company |

| $115 for 1-year registration$175 for 3-year registration | $115 | $315 |

These prices are only for registration to the governing bodies. Hiring a business incorporation agent like IASG will ease the process of collating and preparing documents, company registration, local bank account opening, appointing a corporate secretary and local nominee director, immigration advisory, and more.

In addition to business incorporation services, IASG offers relocation services to foreign business owners seeking to migrate here. This includes advisory on the application process for the various passes and other services such as house hunting and school registration for children.

Therefore, the cost to starting a business in Singapore as a foreigner varies depending on specific needs of a business owner. To get all the necessary registrations and set up done right, enquire with Immigration@SG for a turnkey incorporation service.

Running a Business in Singapore

In this section, we cover the following:

- Business grants

- Setting up an office

- Employment procedures

What Business Grants are Available to Foreigners?

To ease the costs of starting a business, Singapore introduced a slew of business grants to entrepreneurs in conjunction with generous tax exemptions. A few offered by the government and its agencies are:

- Market Readiness Assistance (Enterprise Singapore)

- Enterprise Development Grant (Enterprise Singapore)

- Business Improvement Fund (Singapore Tourism Board)

- Experience Step-Up Fund (Singapore Tourism Board)

- Aviation Development Fund (Civil Aviation Authority of Singapore)

- Agri-Food Cluster Transformation Fund (Singapore Food Agency)

- Electric Vehicle Common Charger Grant (Land Transport Authority)

- Productivity Solutions Grant

Many more grants are offered by other institutions such as banks, including UOB’s SME Micro Loan programme.

How Do I Set Up an Office in Singapore?

Setting up an office in Singapore can be intimidating due to rental costs and the state of the property market.

Most businesses in Singapore are based in the Central Business District, and many more are based in industrial parks or specialised agglomerated hubs such as Fusionopolis. Foreign business owners looking for an office space should consider:

- How much of my budget will I allocate to office rental?

- What are the company’s physical and manpower needs, and how much space is needed to accommodate these activities?

- What services am I providing?

- Which market am I targeting?

Office rental can be complicated and having a physical address is necessary for the registration to go through. IASG can refer clients to our property partners for office space rental as part of the preparations for ACRA registration.

What are the Employment Procedures I have to Undertake?

The Employment Act governs the hiring and firing of employees and workers’ rights in Singapore. Before embarking on recruitment, business owners must ensure that they provide their employee with the benefits and rights outlined in the Act.

While the Singapore Companies Act does not require companies to hire a specific number of employees in the country, foreign-owned firms must fulfil the following:

- A local manager for non-resident sole proprietors or LLPs

- A company secretary ordinarily resident in Singapore for private limited companies

- A nominee director ordinarily resident in Singapore for private limited companies (but does not have to be involved with the company in any capacity)

- An auditor ordinarily resident in Singapore for private limited companies

Companies hiring foreign professionals should obtain work visas for their employees and register for work passes, such as the Employment Pass or S Pass (depending on the professional’s job scope).

- Employment Pass (EP) applies to most professionals earning $5,000 and above, who are mostly high-skilled workers

- S Passes are issued to mid-skilled workers

- Work permits are issued to basic-skilled workers depending on sector

IASG offers services for EP applications. For many, the EP is a pathway to become Singapore permanent residents and eventually acquire citizenship. We can assist you with applying for passes for your employees.

Conclusion

Incorporating in Singapore is a big decision and commitment. As a top-tier financial hub, Singapore offers many benefits and opportunities to aspiring entrepreneurs and business owners: access to the lucrative markets of Southeast Asia, a full suite of high-quality, high-end financial services such as wealth and investment management and numerous incentives that ease the process of incorporation.

The incorporation process can be daunting due to the bureaucracy that surrounds it. At IASG, we pride ourselves on our expertise and years of experience working directly with foreign professionals and business owners worldwide to set up businesses in Singapore. We also offer advisory on related issues such as work pass applications and relocation, adding to the comprehensiveness of our incorporation services. We tailor our services to suit your specific needs.

If you are interested in incorporating in Singapore, you may contact us at info@iasg.com.sg or call us at +65 6493 1830. We hope that this guide has been helpful to you.