E-payment systems have grown in Singapore due to the pandemic. However, going completely cashless presents some challenges.

Growth of e-Payment Systems in Singapore & Its Effects

Since the inception of the first contactless payment technologies in Singapore nearly a decade ago, the use of cashless payment has grown exponentially. At 97%, Singapore has the highest cashless payment adoption rate in Southeast Asia. With initiatives such as Grab’s loyalty programmes and new partnerships between DBS PayLah! and various merchants, the cashless payment ecosystem will only deepen further.

Going Digital: the FAST System

Singapore’s e-payment ecosystem depends on an electronic funds transfer system known as FAST (Fast and Secure Transfers).

FAST was first launched in 2014 by the Association of Banks (ABS) in Singapore to support increasing demand by the market for faster, more efficient bank transfer services. Prior to FAST, systems such as interbank GIRO would take days to complete transactions. Too slow to keep up with the rapidly-rising rate of consumption, FAST was introduced to enable real-time, instantaneous transfers.

Early Adoption

Adoption of FAST was extremely slow at first. In 2016, DBS launched PayNow, an overlay service tapping on FAST’s national infrastructure to complete payments. PayNow significantly boosted adoption: most people already had a mobile phone and DBS bank account, making the switch to PayNow simple. Additionally, PayNow enabled point-of-sale and P2B (peer-to-business) lending, boosting its utility to customers and thus adoption rate. PayNow Corporate was launched two years later, attracting merchants to the payment system and unifying consumers and businesses. With such a tightly-integrated payment system, adoption would only increase as cashless payments became mainstream.

Usage Increase

In 2020, cashless payment usage increased significantly due to reliance on contactless payment. Customers who were previously not on PayNow or other digital wallets were forced to adopt these modes of payment. Cashless payment became entrenched into daily life and, with more users on board, the national ecosystem was now even more integrated. The pandemic also saw the rise of e-commerce, traditionally reliant on payment modes such as digital bank transfers and PayPal, further normalising cashless payments. E-payment modes, including the use of Apple Pay and Samsung Wallet, also became extremely popular: more Singaporeans than ever were using their mobile wallets to pay transport fares, purchase goods and accumulate loyalty points—all with a single tap of their phones at a contactless terminal.

Diversification of e-Payment System in Singapore

Today, Singapore’s e-payment ecosystem has deepened and diversified. Loyalty programmes, cashback and BNPL (buy now, pay later) schemes are being hosted on platforms such as GrabPay. Non-bank financial institutions can now access FAST as direct participants, increasing the system’s financial uses. Mobile wallets and digital bank accounts can now be integrated into budgeting apps and investment trackers. E-payment has become such an integral part of daily life, that most young Singaporeans no longer find themselves bringing hard cash with them.

Technological Developments in e-Payments & Their Benefits

The development of e-payments in Singapore is closely linked to the Smart Nation plan, an effort to digitally transform Singapore society at every level – government, business, and the general public. Not only have e-payments digitalised business and service exchange, but they have also fundamentally transformed everyday spending habits. These transformations are often driven by private sector innovations—many featuring foreign professionals at their hearts.

Whatsapp’s In-Chat Payment System

In 2023, WhatsApp introduced in-chat payments to the Singapore market, pioneering the inclusion of commerce in digital communication. Instead of leaving the app to perform a digital transfer, customers can now transfer money directly to the merchant through WhatsApp’s native ecosystem.

WhatsApp’s native payment feature eliminates the challenges SMEs (small-medium enterprises) often face while conducting business. SME owners can receive the money directly from customers without the hassle of setting up a Shopify account or registering as a corporate entity (particularly challenging for small, independent businesses). The function is also free-to-use, reducing the barriers to entry needed for new SMEs to engage in business. Customers also find it much more efficient to transact with SME merchants directly in-app, reducing lost transfers and encouraging repeat business.

Most importantly, WhatsApp’s new feature presents a viable alternative to DBS PayNow and PayLah!, reducing dependence on only a few transfer systems. In 2021 and 2022, DBS and OCBC’s outages disrupted the business activities of millions of people reliant on their digital transfer services in the country. The introduction of WhatsApp’s payments feature could ease such issues by diversifying the national e-payments ecosystem.

Singapore’s Need For Immigration of Tech Professionals

WhatsApp’s innovations, led by foreign professionals, illustrate several important points:

- Foreign professionals contribute new ideas to the economy. Compared to existing payment systems such as PayNow and PayLah!, WhatsApp’s native payment feature allows transactions to occur within a digital conversation, simplifying the transaction process. This innovation reduces any hassle and lost transfers as customers no longer have to switch between apps. Singapore has thus benefited from the novel innovations of foreign MNCs like WhatsApp and their professionals—these new ideas not only solve existing problems, but also add value for consumers.

- Foreign professionals in the private sector help diversify the economy. Singapore’s e-payments landscape is largely monopolised by local legacy institutions such as DBS. The introduction of foreign MNCs and tech professionals drive innovations that complement and provide viable alternatives to existing payment structures, reducing economic weaknesses and stimulating new avenues for business activities.

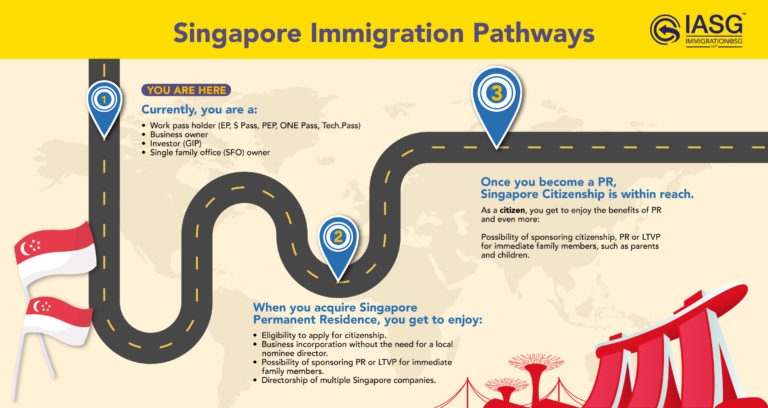

In line with the Smart Nation plan, the Singapore Government launched Tech.Pass, a type of Work Pass offered in Singapore, to attract tech entrepreneurs, professionals and researchers to the country. Targeted at the top 10% of Employment Pass (EP) professionals, Tech.Pass holders and their corporations are exploring new ideas such as internet-free contactless payment, using Singapore as a sandbox for testing new ideas. The e-payment space looks very promising, especially with the advent of artificial intelligence (AI)—but does present its own challenges.

Challenges & Opportunities of e-Payment Adoption

Social Exclusion Due to Lack of Digital Literacy Amongst the Old

E-payment systems run the risk of social exclusion. In particular, many elderly Singaporeans find the technology challenging to use due to lack of digital literacy: they find mobile interfaces unintuitive, hard to read and complex, discouraging them from adopting mobile payments. Some illiterate or visually-impaired elderly may also find the textual nature of mobile payments (such as the need for UEN, business names and phone numbers) difficult to understand. With few educational efforts centred around digital financial literacy, a high percentage of elderly consumers prefer hard cash, citing a fear of scammers, low trust in digital security and the tangible nature of hard cash as reasons. However, in a world where merchants are increasingly rejecting hard cash (and no longer have physical cash boxes), elderly Singaporeans find themselves excluded from consumption.

Business Cost For Elderly Hawkers

An extension of this issue can be observed in struggling elderly hawkers. Due to their lack of digital knowledge, elderly hawkers were unable to bring their businesses online during the pandemic, resulting in declining sales. Mobile payments alone were already unintuitive—much less the complex process of setting up a digital shop and building up a complete digital business structure. Left behind by the sweeping changes taking place in the F&B industry, many elderly hawkers were forced to close shop between 2020-2022.

To bridge the gap, the “Hawker Champion” initiative was launched in 2020 to onboard 18,000 elderly hawkers to digital platforms and teach them digital literacy skills. A collaboration between the Singapore Government and NETS, the project reached all 112 hawker centres in the country, and its effects can still be seen today: the QR code payment mode introduced by the initiative has become a hawker centre mainstay. While more incentives have been rolled out to encourage hawkers to go digital over the past few years, the most important solution remains to be education: teaching hawkers how to run a digital business, identify scams, collect mobile payments and coordinate online orders.

Rise of Scams & The Need for Cybersecurity

The rise of e-payments has also seen a rise in scams. Artificial intelligence has made possible complex forms of impersonation and identity theft, bypassing digital security systems altogether by directly manipulating victims. Examples include video call fraud: scammers impersonating police officers video call victims, convincing them to give up their digital account details to assist with “investigations” into fake “hacking” scandals.

Finally, cybersecurity risks have risen dramatically with the adoption of e-payment. Due to its dependence on an Internet connection and singular infrastructural set-up, an attack on the FAST system or any of its overlays (in this case, national banks like DBS and OCBC) can cause entire payment systems to come crashing down. In 2021 and 2022, DBS and OCBC reported numerous disruptions to their digital banking services, resulting in millions of dollars of lost revenue, business activity and productivity hours. Without digital services available, many customers were also unable to conduct transactions since a large number had gone cashless.

Besides the need for more sophisticated cybersecurity systems, the infallibility of e-payment systems points to the importance of multiplicity. Multiplicity refers to the existence of alternative modes of payment, such as hard cash, traditional credit/debit card transactions and NETS. A robust payment ecosystem is ideally a diversified one: one that does not have a single point of failure. Multiplicity also prevents social exclusion as it preserves traditional modes of payment, and in time encourages the development of alternative modes of digital payment that can strengthen the existing e-payment ecosystem—as seen in the introduction of WhatsApp payments.

Growth of e-Payment Systems & Its Impact on Singapore’s Immigration

Boosts Singapore’s Economic Growth

E-payment in Singapore has contributed to significant economic growth: it boosts revenue, encourages more revenue-generating activities and consumption and has led to the expansion of sectors such as e-commerce, further diversifying the national economy. The further development of the e-payment ecosystem is a key Smart Nation goal, with the added considerations of social inclusion and accessibility in mind.

An Effect of Digital Technology Boom

Innovation in the e-payments space has largely been driven by breakthroughs in artificial intelligence, cloud computing and other digital technologies. Many local and foreign professionals have been closely involved in these developments, including the many social initiatives to bring marginalised or traditionally-excluded demographics on board. The growth of e-payments can and should be sustained by a consistent inflow of foreign talent, who are critical to supporting the efforts of local leaders—and in turn, the development of e-payments will enhance, enrich and expand economic activity in the country, leading to a stronger economy and way of living.

Singapore’s Immigration Needs in Tech Sector

Growth of the e-payment system is just one of the many branches of the booming tech sector. To meet these needs, Singapore has implemented various initiatives to attract and retain talent in the tech industry. The government has introduced the Tech.Pass program, which allows experienced tech entrepreneurs, executives, and experts to work and live in Singapore for up to two years, with the option to renew for 2 more years. Additionally, there are several Work Passes, such as the Employment Pass (EP) and the S Pass, which facilitate the hiring of foreign tech workers. These immigration policies reflect Singapore’s commitment to fostering innovation and maintaining its position as a leading tech hub in the region.