The Singapore Government has announced an increase in minimum investment for Global Investor Programme (GIP) candidates to SGD10 million, previously at SGD2.5 million.

The Change in Minimum Investment Amount

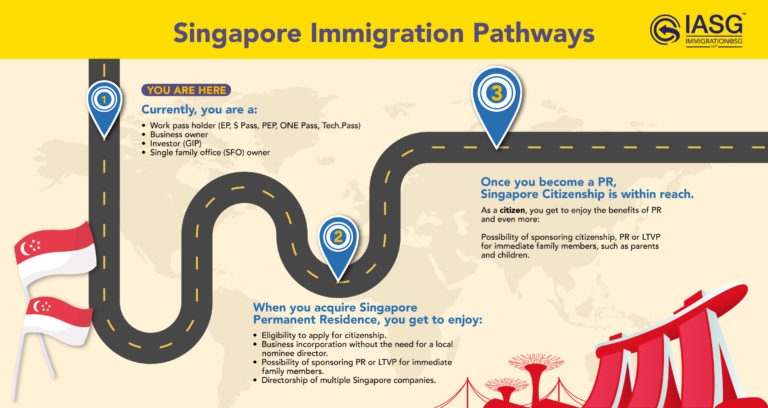

Prospective individuals investing in Singapore through the Global Investment Programme (GIP) must start investing even higher amounts of money, should they wish to qualify for Permanent Residency status.

The change, announced on Thursday (March 2), was put in place to improve the attraction of top business owners and investors, as well as to increase the amount of funds flowing through the Singaporean economy. From March 15 onwards, the change will apply to all three investment options under the scheme.

Policy Changes

Prior to the change, foreigners who invest at least $2.5 million into Singapore could qualify for Permanent Residency under the scheme. These investors would have to invest in a new or existing Singaporean business, Singaporean-based single family office with at least $200 million in AUM (assets under management) or GIP fund investing in Singapore-based firms.

Under the new change, prospective investors must now meet one of the following criteria:

- If investing in a new or existing firm, applicants must invest at least $10 million including paid-up capital.

- If investing into a GIP-select fund, applicants must invest at least $25 million and the fund of choice will be selected based on its track record and investment mandate, among other factors.

- If establishing a family office, the office should have at least $200 million of AUM, of which at least $50 million should be deployed in: companies listed on MAS (Monetary Authority of Singapore) licensed exchanges, debt securities and certificates of deposit on MAS’s enquiry system, funds by Singapore-licensed managers on MAS’s list of financial institutions or private equity funds in non-listed Singapore-based firms.

Changes have also been made to the GIP renewal framework.

- If investing in a new or existing firm, employers must hire at least 30 personnel, 10 of whom must be new employees and half of whom (out of all personnel) must be Singaporean, as well as accrue at least $2 million in business costs.

- If investing into a GIP-select fund, existing investors must maintain their monies in these funds.

- If establishing a family office, existing investors must maintain their $50 million investment in any of the four categories listed above and hire 5 new family office professionals, including at least 3 Singaporeans.

Impact of Changes

By increasing the minimum investment requirement, the Singapore Government hopes to attract high-quality investors who are more likely to ground themselves in the country. This change ensures that investments into Singapore will be sustainable over longer periods of time, allowing Singapore to achieve its long-term growth goals. Attracting investors who are more willing to commit to the country also creates even more employment opportunities for local professionals over time, boosting the country’s global reputation as a financial services powerhouse.

Singapore also aims to use the GIP as a vehicle to tap into the wider Southeast Asian economy. As emerging markets like Indonesia become more competitive, investors interested in or familiar with the Southeast Asian landscape in particular are welcome to apply. Singapore enjoys enhanced status as a gateway to Asia through the GIP, and will find its relationships with its neighbours improving as cross-national trade and investment strengthens.