In an era defined by geopolitical uncertainties, Singapore is a preferred destination for foreign investments by corporations and high net worth families. This commentary is specifically referring to the escalating political tensions between Taiwan and mainland China and discusses Singapore’s position as an investment haven in the region.

The recent analysis by the South China Morning Post (SCMP) sheds light on Singapore as a stable investment haven with a strategic location, resilient infrastructure, and investor-friendly policies.

Increased tension with economic powerhouse China, have countries such as Taiwan, Hong Kong, and most notably, the USA facing political and economic risks. Strategic moves have been made by all parties such as China’s suspension of tariff cuts for 12 chemical compound imports from Taiwan and trade restrictions, Taiwan’s control of the production of its manufacturing plant in China, and USA’s de-globalisation policies by domesticating production back to America instead of buying from China.

The SCMP article also underscores a notable surge in interest from Taiwanese companies to set up offices in Singapore, attributing this to factors such as cultural affinity, shared language, and historical ties. Singapore’s diverse talent pool and global market connectivity offer Taiwanese businesses a platform for international expansion and collaboration, making Singapore an attractive destination for companies seeking strategic opportunities beyond regional uncertainties.

How Does Foreign Investments Affect Singapore?

Increase in Corporation Presence

The surge in foreign investments holds promise for the nation’s economic growth, job creation, and technological advancement. Taiwan is currently producing 60% of the world’s chips and about 90% of the world’s most advanced ones. This is a clear testimony of Taiwan’s semiconductor prowess. Vanguard International Semiconductor, an affiliate of Taiwan Semiconductor Manufacturing Co., has been eyeing Singapore to build a new advanced chip manufacturing plant. If this plan materialises, the investment would be worth at least $2 billion. Taiwan’s second-largest contract chipmaker, United Microelectronics Corp. (UMC), is already building a $5 billion plant in Tampines, Singapore.

With Singapore’s Industry 4.0, a government initiative to streamline processes for automation and data exchange in manufacturing technologies, the Taiwanese chip manufacturers will be supported by an enhanced infrastructure that optimises resources for best performances in a connected ecosystem for manufacturing, integrating computing, networking, and physical processes. This is a win-win situation for both Singapore and Taiwan.

Increased Need for Specialised Foreign Talent

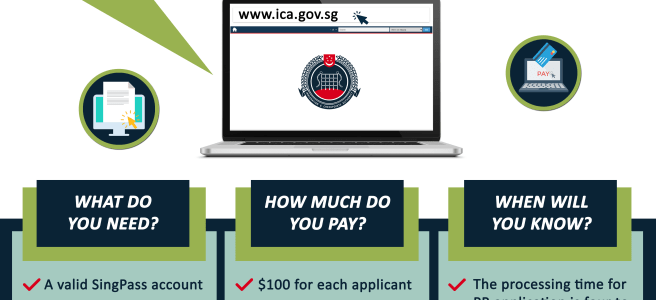

With Taiwanese businesses showing increased interest to set up their bases in Singapore, an increase in job hiring can be expected. Due to Singapore’s expertise gap in the advanced manufacturing sector, there will be a need for foreign talent to enter the workforce quickly, thus affecting inbound immigration. Locals may need to upskill to fill up the available positions as well. At IASG, we have seen an increase in the number of Employment Pass and ONE Pass applications, especially those in the advanced manufacturing, technology, and finance sectors. We also see an increase in Singapore PR applicants from these sectors.

Increase in HNW Individuals & Family Offices

Businesses are not the only ones moving to Singapore when political instability arises, the wealthy are interested as well. In recent years, high net worth Chinese and Hong Kongers are moving to Singapore as well. This is apparently because they have more to lose when their businesses and investments stay in an uncertain economic climate. The number of family offices in Singapore has seen a great jump in the last few years. The move is to not only protect their wealth but also to take advantage of the opportunities in Singapore.

Migration Patterns of Political Instability on Singapore

However, Taiwan is not the only one moving their investments and businesses to Singapore. The Chinese are doing the same as well. Getting both ends of the stick definitely increases the benefits for Singapore economically. The same happened during Hong Kong’s protests in 2019. In summary, political conflicts and uncertainties around the region, especially in countries with developed economies will benefit Singapore, as long as Singapore maintains its favourable position.

Singapore’s Position as an Investment Haven

Singapore’s position as an investment haven amid the Taiwan-China tensions brings forth an increased economic outlook on the overall. Increase in the number of family offices, manufacturing plants, foreign talent are all indicators of a robust economy.

Singapore has the knack to attract investments globally when markets are calm and even during crises. Apart from the Taiwan and China conflict, Hong Kong protests, and Chinese economic and political changes, another example would be the surge of American pharmaceutical manufacturing plants such as Pfizer establishing and/or increasing their investments in Singapore to produce vaccines and medical-grade face masks during the peak of COVID-19. Singapore’s ability to navigate its economy in recent years is a testament to its status as one of the richest countries in the world.