Single Family Office

With a comprehensive financial framework, infrastructure, and tax incentives, Singapore is the perfect place to manage wealth, businesses, and investments via a family office structure. The government has been improving the financial landscape over the years and is still expanding its reach to increase jobs in the financial sector by attracting top talents internationally and digitalising financial services.

Tap on Singapore’s fascinating financial landscape & manage your wealth from here!

Truly, The Family Office Hub of Asia

Since 2016, on the back of rising growth of Asian wealth, an increasing number of families are consolidating their wealth in Singapore through formal structures, such as family offices. These family offices are regulated by the only financial regulating arm in Singapore – the Monetary Authority of Singapore (MAS) along with the Singapore Economic Development Board (EDB). Together, these government agencies enhance Singapore’s competitiveness as a global wealth management and family office hub.

Unlike incorporating a standard company, setting up a family office involves much more intricacies including wealth management planning, taxation advisory and intensive due diligence with regards to source of wealth.

Largely in part to favourable business and political landscape, Singapore has been one of the first choices in Asia for those intending to consolidate their wealth. This comes amidst strong governmental support to position Singapore as the leading South-east Asian financial hub. In this Single Family Office setup, the mandate for most would be to manage investments as well as to encourage philanthropic activities in Singapore.

IASG can provide consolidated solutions for family offices set-up with different investment and asset allocation strategies. Our track record in handling Ultra High Net Worth (UHNW) individuals and business immigration needs into Singapore remains stellar. We have strong representation of UHNWIs from China, India, UK and U.S.A among many others.

Our intimate knowledge of Singapore’s immigration policies will prime business owners and UHNW individuals for a hassle-free experience. We handle all application matters from paperwork, project management and liaison with the various government agencies where required.

Objectives & Benefits on Setting Up an SFO

A Single Family Office (SFO) is typically set up to serve several purposes that are aligned across diversifying objectives. These can differ greatly and often, objectives are unique for different families. Some of the most common objectives include :

- Wealth Preservation & Growth

- Tax Planning Efficiency

- Generational Legacy Planning

- Avoidance / Mitigating Family Disputes

- Permanent Residency

- Education for the Children

- Navigating Macro Geopolitical & Environmental Hazards

- Philanthropy

As each family requires differing goal management, determining long-term strategy helps define the detail and level of bespoke solutions to address the needs and requirements of each family.

With close support from regulatory bodies and the economic board, Singapore has increasingly become the jurisdiction of choice for the set-up of a family office and family funds. it meets the criteria that many families are looking for, including :

- The Safety Net of a Strong Regulatory Framework

- Assurances of Working with Established Financial Services Providers and Robust Infrastructure

- Consistently having a Stable and Pro-Business Government Policies

- Wide Access to Skilled Labour Force and Talent Pool

Singapore Immigration Roadmap

You are here

- Foreigner living in or outside of Singapore

Current Goal

- Set Up Single Family Office + Apply Relevant Work & Dependent Passes (for self and immediate family members)

Future Possibilities

- Singapore PR + Social Integration

- Global Investor Programme (fast-track option to Singapore PR)

- Sponsor PR/CItizenship/LTVP for immediate family members

- Singapore Citizenship + Social Integration

Typical Pathway to Successfully Incorporating a Family Office

1. Determining Objectives

- Defining Family’s Vision & Goals

- Understanding level of Family’s Involvement

- Defining the Assets to be Managed

Families can discuss internally to determine the family’s investment needs and goals.

2. Detailing a Business Plan

- Jurisdiction and Geographical Analysis

- Tax Planning requirements

- Defining the Right Legal Structure Set-Up

- Projecting Operational Costs & Budgets

- Complementary Services Requirements

Families engage specialised service providers under Team IASG (Business Incorporation, Immigration, Tax, Legal, Finance, Banking Professionals) to be advised on efficient structures to manage their wealth and assets and assist with the end-to-end setup process.

3. Setting Up & Implementation

- Business Incorporation & Infrastructure Set Up

- Recruitment of Qualified personnel

- Establishing Advisory Committees

- Licencing exemption & Tax Incentive applications

- Establishment of key organisation functions, standard operating procedures

IASG will assist in the incorporation of family office structure, assessment and application for licensing / exemptions. Recruitment and real estate specialists can assist in the hiring of professionals and sourcing of office and residential space for key family office principals and executives to spearhead operations in Singapore.

4. Commencement of Operations

- Commence Family Office operations

- Benchmarking and Key Performance Indicator Measurements

- Plug into family office & investment network

- Build on and expand family office objectives and functions

Besides commencing the family office operations, families can also explore family office related networks, events and initiatives to be exposed to investment opportunities and be plugged into Singapore’s vibrant family office ecosystem to achieve the continuation of family legacy across generations.

Single Family Office (SFO) Structures

Single Family Office (SFO) structures are highly customisable according to the needs and goals of each client. Different family has different focuses, interests, and goals. Below are some common SFO structures in Singapore that clients may adopt.

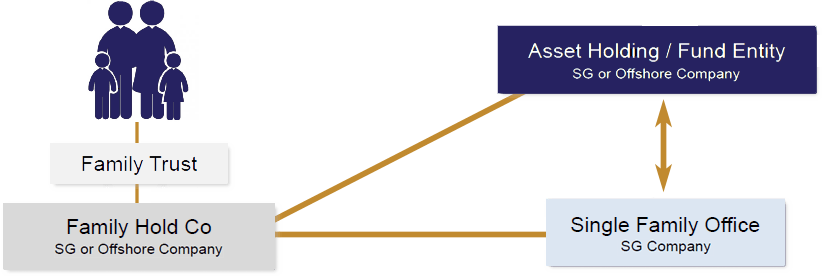

SFO Structure 1

General Notes

- Investments sit under a separate investment holding company, for purpose of segregation of assets/liabilities with the SFO entity.

- SG Asset Holding Entity is able to apply for Fund Tax Incentives, if criteria can be met.

- Offshore Asset Holding Entity qualifies for Offshore Fund Tax Exemption Scheme.

Family Trust

- Optional Trust to be managed by Trustee.

Asset Holding / Fund Entity

Deployment into investment assets such as:

- Properties

- Equities of listed/unlisted companies

- Insurances

- FX/Derivatives

- Bonds/Warrants

Fund Manager

- Family and investment professionals (employees) to be employed.

- To obtain legal opinion or formal approval from MAS on fund license exemption, aids with fund tax exemption application.

Investment Management Agreement

- Refers to the Agreement between Asset Holding / Fund Entity and the Fund Manager.

- Family Office Company provides management services to the Fund entity in return for management fees.

SFO Structure 2

General Notes

- Investments sit under a separate investment holding company, for purpose of segregation of assets/liabilities with the SFO entity.

- SG Asset Holding Entity is able to apply for Fund Tax Incentives, if criteria can be met.

Family Trust

- Optional Trust to be managed by Trustee.

Asset Holding / Fund Entity

Deployment into investment assets such as:

- Properties

- Equities of listed/unlisted companies

- Insurances

- FX

- Bonds/Warrants

Single Family Office (Fund Manager)

- Family and investment professionals (employees) to be employed.

- To obtain legal opinion or formal approval from MAS on fund license exemption, aids with fund tax exemption application.

Investment Management Agreement

- Refers to the Agreement between Asset Holding / Fund Entity and the Single Family Office.

- Family Office Company provides management services to the Fund entity in return for management fees.

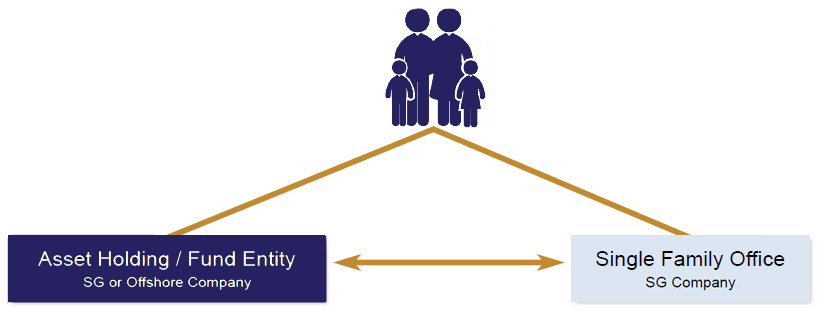

SFO Structure 3

General Notes

- Investments sit under a separate investment holding company, for purpose of segregation of assets/liabilities with the SFO entity.

- SG Asset Holding Entity is able to apply for Fund Tax Incentives, if criteria can be met.

- Offshore Asset Holding Entity qualifies for Offshore Fund Tax Exemption Scheme.

Asset Holding / Fund Entity

Deployment into investment assets such as:

- Properties

- Equities of listed/unlisted companies

- Insurances

- FX

- Bonds/Warrants

Single Family Office (Fund Manager)

- Family and investment professionals (employees) to be employed.

- To obtain legal opinion or formal approval from MAS on fund license exemption, aids with fund tax exemption application.

Investment Management Agreement

- Refers to the Agreement between Asset Holding / Fund Entity and the Single Family Office.

- Family Office Company provides management services to the Fund entity in return for management fees.

More Information

Relocation Services

For a country like Singapore — consistently awarded Most Competitive Economy in Asia to do Business and Safest to Raise a Family — the systems and infrastructure built over time comes at a cost. Sound policies and processes in place are the backbone of such efficiencies and as such, you will need all the help you can get to ensure a smooth transition. To ease the move, Immigration@SG (IASG) offers a full-suite of critical service solutions to navigate you pass the finish line.

Featured SFO News

Singapore’s Tightening Job Market: Warnings and the Need to Pivot

In a tightening job market, how do foreigners seize opportunities in Singapore? This article explains the changing job scene and how to navigate it.

Gaming Industry in Singapore: Business Growth and Talent Opportunities

What are the available opportunities Singapore’s gaming industry for foreigners? IASG breaks down its scope, business landscape and foreign talent needs.

Singapore vs Shanghai: Competing as Global Financial Hubs and Trading Ports

Is Shanghai Singapore’s competitor in finance and trade? How should Singapore get ahead?

Singapore’s Inbound Investments in 2025

Singapore has seized a sizeable inbound investments amount of $14.2 billion in 2025. What does this mean and how does this benefit its residents?

Is Indonesia Competing with Singapore For Investments?

Is Indonesia competing with Singapore for investments? Recent news on Indonesia’s progress in the financial landscape seem similar to Singapore’s initiatives.

Singapore’s Stock Market & IPO Opportunities

Singapore has recently announced a big injection of funds to boost its stock market. Can a foreigner take this opportunity to invest in Singapore?

FAQs

Depending on the level of involvement and expertise members of the families have, family offices may employ professionals to manage the set up and running of its operations. Typically an established family office should have the capabilities to perform :

- Wealth Preservation & Growth

- Tax Planning

- Generational Legacy Planning

- Avoidance / Mitigating Family Disputes

- Permanent Residency Applications

- Education for the Children

- Navigating Macro Geopolitical & Environmental Hazards

- Philanthropy

There are also “bread-and-butter” duties of managing a family office — from keeping the books for businesses and investments to dealing with tax matters — the office will help it prepare for its future, assuming such tasks as estate and tax planning, risk management and succession planning.

The setting up of a Family Office is not as simple as incorporating a typical private limited company. Incorporating an entity is just one of the steps. A brief outline of how to incorporate a Family Office has been detailed above section “Typical Pathway to Successfully Incorporating a Family Office”. Approach IASG for a consultation.

The number of Family Offices in Singapore has been steadily increasing since 2016 and now stands at 700 at the end of 2021.

You will need to go through the entire process detailed in the “Typical Pathway to Successfully Incorporating a Family Office”. Obtaining the licence is merely one of the deliverables included in the journey.

There are no minimum size requirements. The family office can run as lean as a Single person or can go up to 5 family members. Typically though, the decision makers of the family engage a myriad of professionals, each with their own unique focus to come together in running the family office efficiently and according to a defined plan.

Singapore’s reputation as one of the most business-friendly jurisdictions in the world with world-class financial infrastructure and workforce makes it one of the top financial hubs in the world. Singapore is expected to receive 2,800 millionaire arrivals by the end of 2022, a testament to its financial environment and standing. This is an 87% increase compared to pre-Covid times in 2019.

The Singapore government is ramping up efforts to increase the number of top talents, especially in financial services such as financial advisor, tax specialist, estate planner, accountant, and more. Unlike many developed countries, Singapore does not levy any capital gains or estate tax or tax on foreign-sourced income. Availability of the best asset and wealth management professionals in Singapore also help facilitate wealth preservation.

Depending on the goals of a family, the family office structure differs and can be customised accordingly to serve varying objectives. Generally, a family office is a well-coordinated, collaborative effort by a team of professionals from the legal, insurance, investment, estate, business, and tax disciplines. Responsibilities of a family office include legacy planning and management, lifestyle management, investment management, and family wealth education.

While one client may need a family office for high-calibre advice from a range of experts in regards to wealth management, business management, and investments, for example, another may need a family office to to include legacy planning or front philanthropic activities.

A single-family office serves one individual and their family, while multi-family offices serve more than one family, and could be less expensive in the long run due to economies of scale. At least $100 million is needed to qualify for a single family office while a multi family office needs at least $30 million (figures are minimum estimates based on median AUM at start of incorporation). There is a common or singular goal for single family offices so the client has definite control while multi family offices take into account the different goals of the multiple families.

In single family offices, the team mainly consists of high-profile ex-consultants and / or investment bankers who only work for the client. Multi-family offices often employ a pool of former associates of private banking divisions or staff from other multi-family offices, therefore, staff may be doing work for multiple clients at the same time.

A family office is a private wealth management firm that is set up and run by a high net worth family to manage their affairs. The family office can be set up as a trust, corporation or partnership. So a family office may not be a trust, but a trust may also be a family office.