The global semiconductor or chip industry is a crucial sector that underpins a vast array of technologies, from consumer electronics to advanced military systems. How important is this industry in Singapore?

The Global Semiconductor Industry

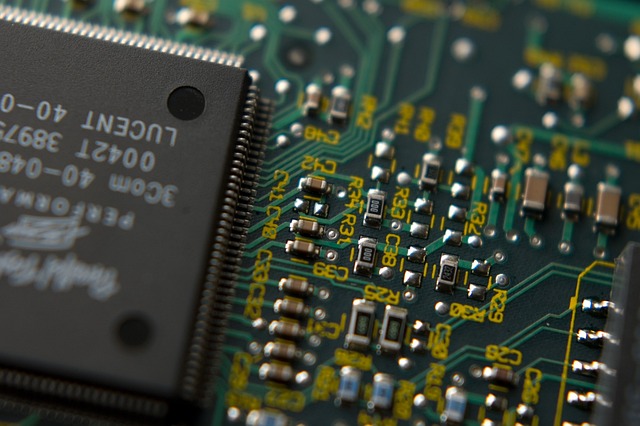

The global semiconductor industry is a cornerstone of modern technology, powering everything from smartphones and laptops to cars and advanced medical devices. Semiconductors, primarily silicon-based materials, control the electrical currents in electronic devices, enabling complex operations such as computing, communication, and sensing.

In 2023, this industry had a total sales of $526.8 billion and is projected to exceed $1 trillion by 2030, driven by the heightened demands for integrated circuits (ICs) in AI, digital economies, and electric vehicles.

Key Players and Regions

The industry is dominated by a handful of countries and companies. The United States, South Korea, Taiwan, China, and Japan are the major players, with companies like Intel, Samsung, TSMC (Taiwan Semiconductor Manufacturing Company), and NVIDIA leading the market. Taiwan’s TSMC is a key player, accounting for a large portion of global chip production, while South Korea’s Samsung is known for memory chips. These companies have a huge impact on the job market and market transformation.

Job Creation and Skill Development

- High-Skill Employment: These companies generate a significant number of high-paying jobs, particularly in engineering, design, and research and development (R&D). Semiconductor manufacturing requires specialised skills in areas such as nanotechnology, chemical engineering, and computer science, prompting a global demand for highly educated and skilled workers.

- Upskilling Local Talent: Major semiconductor players often collaborate with educational institutions and governments to establish training programs that upskill the local workforce. This not only enhances the employability of individuals in regions like Taiwan, South Korea, and the U.S., but also creates a pipeline of talent for sustaining innovation in the sector.

- Indirect Employment: Beyond direct manufacturing and R&D, these companies also drive indirect job creation in sectors like construction (for building manufacturing plants), logistics (for global distribution), and services (such as maintenance, security, and supply chain management). For instance, Samsung and TSMC have huge ecosystems that sustain local economies by supporting thousands of ancillary jobs.

Market Transformations

- Innovation and Competition: Industry giants like Intel, NVIDIA, and TSMC push technological boundaries through innovation. For example, the push for smaller, more efficient chips (such as TSMC’s 3nm chips) while reducing energy consumption, accelerates advancements in sectors like artificial intelligence (AI), 5G, and autonomous vehicles. This competitive drive forces other companies and countries to either innovate or fall behind, leading to rapid technological advancements in various industries.

- Regional Economic Impact: The dominance of companies like TSMC and Samsung has transformed regions like Hsinchu (Taiwan) and Suwon (South Korea) into technology hubs, significantly boosting local economies. Similarly, the U.S. and Japan’s focus on semiconductors has led to high-tech industry clusters, creating wealth, jobs, and economic resilience in specific regions.

- Geopolitical Influence: Semiconductors are considered critical for national security, especially in an era of AI and defence technologies. This has led to increased geopolitical competition, with countries like the U.S. and China vying for semiconductor dominance. Governments are investing heavily in their domestic semiconductor industries, reshaping markets through subsidies, incentives, and trade policies. For example, the U.S. CHIPS Act aims to reduce dependency on Asia by boosting domestic semiconductor manufacturing.

Challenges in Semiconductor Industry

Supply Chain Disruption

One of the industry’s most pressing issues is supply chain disruption. The concentration of production in countries like Taiwan (TSMC) and South Korea (Samsung) creates global dependencies, making these regions indispensable to the entire tech ecosystem. The scarcity of certain chip types, as seen during the global chip shortage, can affect multiple industries, from automotive to consumer electronics.

The COVID-19 pandemic, geopolitical tensions, and the global chip shortage have underscored the industry’s reliance on a few critical suppliers, particularly for advanced chips. This dependency has prompted governments worldwide to rethink their supply chains, encouraging reshoring or diversification strategies to reduce reliance on a few key players. Countries like the U.S. and the European Union are now seeking to localise semiconductor manufacturing to reduce dependence on Asia.

Talent Shortage

The talent shortage in the global semiconductor industry has become a critical issue, driven by rapid technological advancements, increasing demand for semiconductors across industries, and the complexities of chip manufacturing. This shortage affects the entire semiconductor supply chain, from design to fabrication, and poses significant challenges for companies and countries looking to expand or maintain their foothold in the market.

Semiconductor Industry in Singapore

Singapore is a significant hub for semiconductor manufacturing, contributing about 11% of the global market share. The sector is a major part of Singapore’s economy, employing around 35,000 people and accounting for around 7% of its GDP. Nine out of the top 15 semiconductor firms in the world have set up their bases in Singapore, including American chipmaker Micron and German wafer manufacturer Siltronic.

Singapore is preparing 11% more land space in its wafer fabrication parks to attract more semiconductor companies to build their plants in the country. This is in alignment to the growing AI industry. In recent weeks, California-based semiconductor firm KLA has set up its fourth plant in Singapore. Worth S$259 million and adding an additional 400 jobs to its Singapore workforce, this strategic move aims to expand its presence in Asia and worldwide.

Government Initiatives

The Singapore government has initiatives like the Research, Innovation and Enterprise (RIE) 2025 plan, which aims to boost the country’s capabilities in advanced manufacturing and engineering. Recent collaboration between Singapore and India to develop a semiconductor ecosystem that leverages both countries’ strengths to enhance supply chain resilience through policy exchanges focused on ecosystem development, supply chains, and workforce growth.

Challenges in Semiconductor Industry in Singapore

Like the global industry, Singapore faces challenges such as supply chain disruptions, talent shortage, and the need for continuous technological innovation. Below are other challenges that are specific to Singapore.

- Technological Complexity: The semiconductor industry is highly dynamic, with rapid advancements in technology, such as the move from 5 nm to 3 nm chips and beyond. Keeping up with these technological advancements requires continuous investment in R&D, talent acquisition, and upskilling the workforce. Singapore must address the need for skilled labour and highly specialised engineers, as the complexity of semiconductor manufacturing increases. The development of advanced chips for AI, 5G, and other cutting-edge applications demands expertise that can be hard to attract and retain in an industry already facing a global talent shortage. Thus, these specific skills are high in demand for both local and foreign talent.

- Environmental Concerns: The semiconductor manufacturing process is energy-intensive and involves the use of chemicals, making environmental sustainability a growing challenge. As a global manufacturing hub, Singapore faces pressures to balance growth with environmental responsibilities. The industry’s high water and energy usage, coupled with Singapore’s limited natural resources, means that the country must implement sustainable practices in semiconductor production to meet global environmental standards and commitments to reducing carbon emissions.

Opportunities in Semiconductor Industry in Singapore

- Expansion into Emerging Technologies: Singapore has significant opportunities to expand its semiconductor industry by tapping into emerging technology sectors. As industries worldwide shift towards AI, 5G, and electric vehicles, there is a growing demand for advanced semiconductors that power these technologies. Singapore is well-positioned to capitalise on this trend by expanding its capabilities in these areas. By investing in R&D for AI-driven chip design, automotive electronics, and 5G infrastructure, Singapore can become a global leader in producing the next generation of semiconductors.

- Becoming a Global R&D Hub: With its world-class infrastructure, skilled workforce, and favourable business environment, Singapore is positioning itself as a global R&D hub for semiconductors. The country’s focus on innovation allows it to attract multinational semiconductor companies to establish R&D centres. Singapore’s Agency for Science, Technology and Research (A*STAR) plays a key role in driving innovation through partnerships with private industry, focusing on cutting-edge semiconductor technologies, such as quantum computing, AI chip design, and energy-efficient semiconductors. By nurturing this R&D ecosystem, Singapore can move up the value chain and reduce its dependence on low-cost manufacturing.

Semiconductor Industry in Singapore

Overall, Singapore’s strategic investments and favourable business environment position it well in the global semiconductor landscape, while the industry worldwide continues to evolve with technological advancements and increasing demand across various sectors. Businesses and job opportunities are abundant and ready to be seized.

Singapore has been addressing the glaring tech talent shortage by initiating collaborations between semiconductor companies, universities, and technical institutions and creating specialised programs to upskill the local workforce. Initiatives such as internships, scholarships, and on-the-job training can cultivate a local talent pool equipped with the skills necessary for semiconductor R&D, manufacturing, and design. Its Tech.Pass is also a way to attract foreign tech professionals to its shores, ensuring its competitiveness in the market while attracting foreign direct investments (FDIs). By developing a strong pipeline of skilled workers, Singapore can sustain its growth and remain a competitive player in the global semiconductor market.

Immigration@SG has helped tech leaders attain Tech.Pass, a specific work visa for top-tier tech talent worldwide to come to Singapore and advance its industry. Call/Whatsapp +65 8766 1966 or email to info@iasg.com.sg to book a consultation for Tech.Pass application.